About Us

FirstHop is a locally owned and operated Internet Service Provider. We provide businesses in Louisville and Lexington with the critical Internet services they need to thrive.

Our network was built from the ground up with redundancy, security, and reliabilty in mind. We quickly learned that businesses were not happy with the service they were receiving from the cable and telephone companies. This has allowed us to prove the worth of choosing a local ISP and allowed our network to grow at a rapid pace.

Contact Us today for a better Internet connection!

Support

Having a little trouble? It happens to the best of us.Use the links on the right for quick answers to common questions.

- Internet Access

- Hosting

- Colocation

Internet Access

Our network was built with stability in mind. Redundant and reliable, we have multiple uplinks to the Internet backbone. Our core routers work constantly to find the best and fastest route to your Internet destinations.

There are many different ways of connecting to the Internet. We can help you choose from some of the most popular:

- Fiber Optic

- Metro Ethernet

- Wireless

- Cable Broadband

- T1

Hosting

FirstHop offers a wide array of hosting options for your business. Our powerful servers can manage your domain, website, and e-mail with ease.

Colocation

Need a comfortable and secure place for your servers to sit? Escorted access to our chilly data center is available 24 hours a day. With cameras everywhere and on-site building security your servers are safe and sound with us.

Contact us today!

Email us: info @ FirstHop.Net

Call us: 502-694-3320

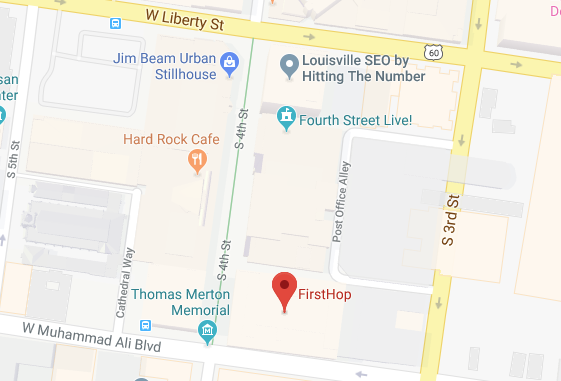

Our Location

Suite 1446

Louisville, KY 40202